INTRODUCTION TO INVESTMENT

INTRODUCTION TO INVESTMENT

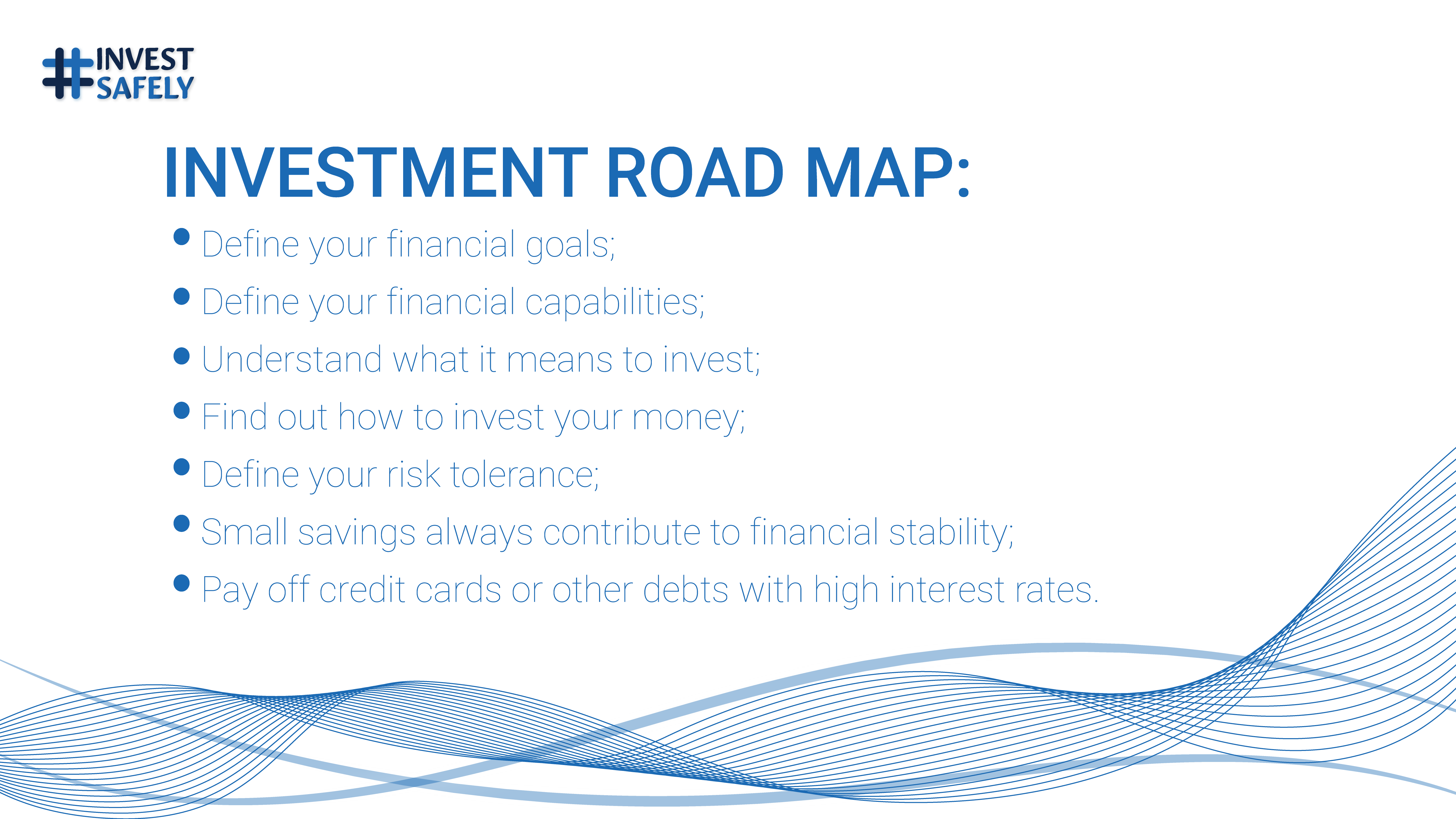

Numerous people focused on financial markets due to their will to invest in a new dwelling, or because are motivated by a lucrative purpose, or they just want to send their children to prestigious universities, or to secure their future upon retirement as well.

In the age of Internet, there are plenty of actual opportunities to invest your own money so that it carries a yield overpowering the process of inflation. The main rule to be complied with when investing in the capital market is to pay attention to the circumstance, whether the investment intermediaries, whose services we make use of in order to achieve our purposes are authorized by the Financial Supervision Commission. The last prerequisite is easily checkable.

The Financial Supervision Commission regulates the manner of offering and selling financial services in the non-banking sector to consumers.

The site on hand is designed to facilitate potential investors in the investment process through providing them useful and detailed information and to prevent them from financial frauds.

What could you do for not becoming victim of financial fraud?

- Pose your questions! It is not sufficient just to request promoters of information. Spend some time for your own investigation through exploring who the regulator of your promoter is.

- Research before investing: mails not wanted, telephone calls and pop-up advertisements on the internet should never be used as single information alternative for your investment decisions. Before investing, it is reasonable to ascertain the business of the respective company, which offers to you its financial services. Even if you know the people advertising financial services, find enough time to investigate the company represented by them.

- Always ask about and make sure of the regulator of the intermediary, which tries to make contact with you through offering investment services! Be extremely cautious when you receive unrequested offers, especially when you cannot find any information online about the respective company! Online advertisements of foreign high yield investments could result in a “scheme” usually related to “off shore institutions” whose beneficial owners are actually untraceable.

- Protect your profiles in the social nets from fishing and always report delovodstvo@fsc.bg on the unrequested offers and/or the unregulated financial services.

DISTINGUISHING MARKS OF THE FINANCIAL FRAUD:

DISTINGUISHING MARKS OF THE FINANCIAL FRAUD:

1. Unwanted calls or text messages; 2. Regulator not indicated; 3. High rate of return offered.

Frauds committed by unlicensed investment intermediaries usually begin through promotion or advertisement, like intriguing online video or email followed by at first glance innocent asking to communicate your phone number and email address.

The purpose of such promotion is to make you believe that there is an inspiring opportunity, which requires immediate action for not missing it. Pay attention before delivering either your phone number or your email address to the promoters! It could be a deceit!

Organizers often try to assure you of a legal investment, whereat they do not ask for money in advance, or allege that the investment is actually riskless. They try to convince you that everything you have to do is to give them both your phone number and email address in order to open an own account or to enter the online portal. After having been registered you start receiving unwanted offers related to the so called “investment opportunities which should not be missed”. It is possible to start getting attacks from call centers, or to state attempts made by someone in order to become friend with you, so that it could inappreciably allure you and make you victim of investment fraud. Fraudsters may also add your data and contact details to a list containing such information about other persons who are already registered. It is also possible to sell subsequently the list in question, including your phone number and email address, to other fraudsters who will involve you in further frauds. All that results in deviation of your investments from the legal and protected investment opportunities.

TRUST ONLY INVESTMENT ADVICE PROVIDED BY PROFESSIONALS!

The choice of a concrete authorized investment intermediary you could rely on during the investment process, as well as of a most appropriate subject of investment are both decisions of utmost importance. If you would like to pose some questions, do not hesitate to use our line for investors free of charge – 0800 40 444, or to fill up our online question form at the following address: delovodstvo@fsc.bg.

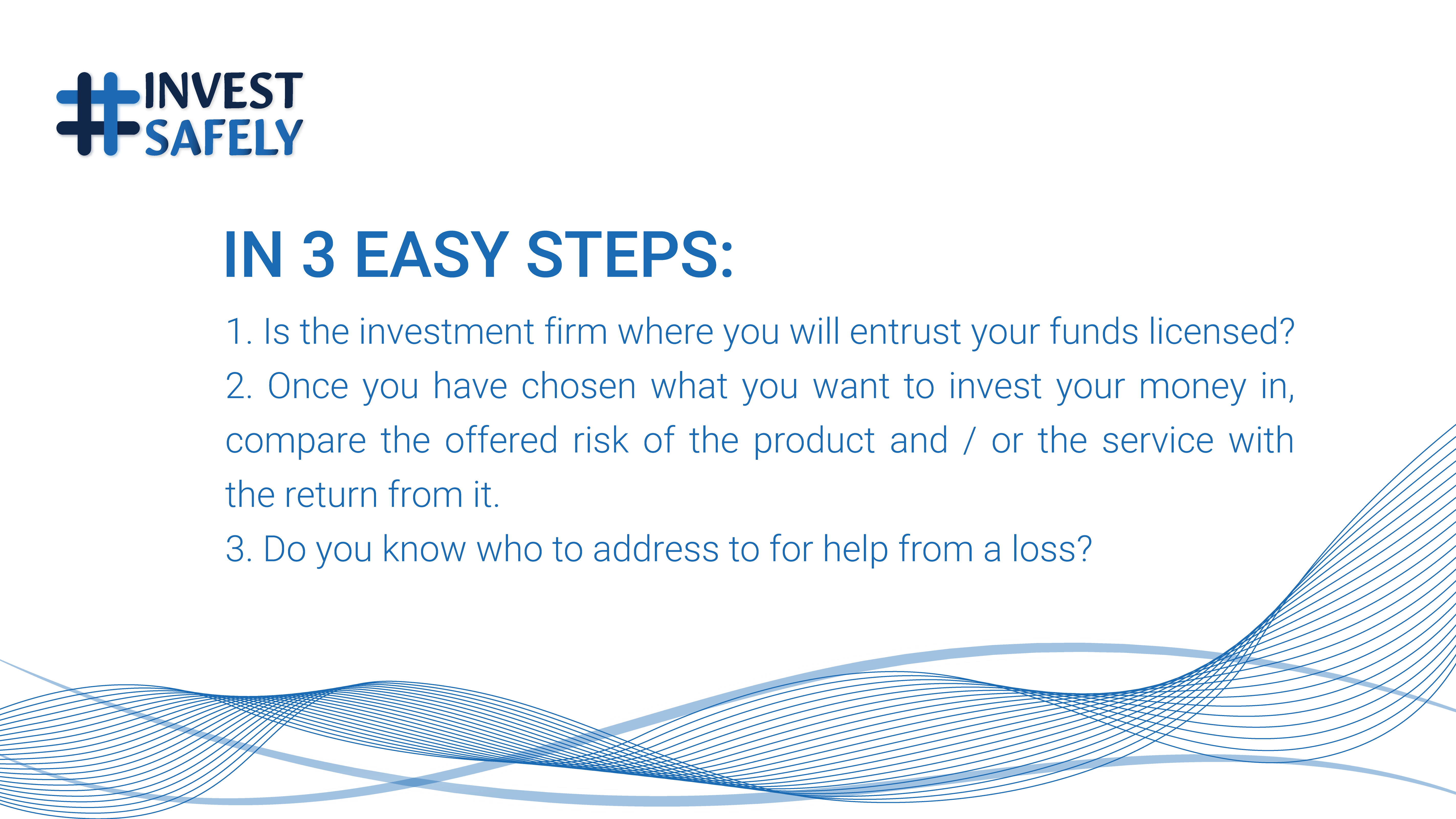

The most important question you should answer to before signing any contract, and particularly before you transfer any money, is whether the person to whom you will confide your means has been licensed either by the FSC, or by any other securities regulator of another EU member state. Trusting with your means person who is not a licensed investment intermediary is extremely risky, thus we appeal to you not to do it.

The site #investsafety offers to you a research tool free of charge, which allows you to recognize whether your investment intermediary is a licensed one.

Look for key words, denominations (either in Bulgarian or in Latin letter), or using PIN, in order to assure whether your investment intermediary is licensed!

INVESTOR COMPENSATION FUND PROTECTS YOUR INTERESTS

Check whether you are under the Investor Compensation Fund protection!

Check hereDISCLAIMER:

The Financial Supervision Commission provides this information in order to protect the investors. The content of this site should not be considered as a recommendation to invest or to refrain from investing. If you have questions about the meaning or the application of a specific code of conduct or of a legal provision, please consult a person who is an expert in the capital markets investing.